It is not your imagination — you are working harder and earning less. Despite significant productivity gains during the past four decades, wages have remained flat.

by Pete Dolack via zcomm.org

This is a global phenomenon, not one specific to any country. It is not a matter of the viciousness of this or that capitalist, nor the policy of this or that government. Rather, widening inequality flows naturally from the ideological construct that now dominates economic thinking. Consider Henry Giroux’s succinct definition of neoliberalism:

“[I]t construes profit-making as the essence of democracy, consuming as the only operable form of citizenship, and an irrational belief in the market to solve all problems and serve as a model for structuring all social relations.”

“Freedom” is reduced to the freedom of industrialists and financiers to extract the maximum possible profit with no regard for any other considerations and, for the rest of us, to choose whatever flavor of soda we wish to drink. Having wrested for themselves a great deal of “freedom,” the world’s capitalists have given themselves salaries, bonuses, stock options and golden parachutes beyond imagination while ever larger numbers of working people find themselves struggling to keep their heads above water.

On the one hand, U.S. chief executive officers earned 354 times more than the average worker in 2013. And even with the bloated pay of top executives and the money siphoned off by financiers, there was still plenty of cash on hand — U.S. publicly traded companies are sitting on a composite hoard of $5 trillion, five times the total during the mid-1990s.

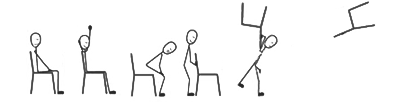

Working harder without getting paid for it

On the other hand, there is the much different fortunes of working people. A study of four decades of wage trends in the United States, for example, revealed that the median hourly wage is less than two-thirds of what it would be had pay kept pace with productivity gains. Authors Lawrence Mishel and Kar-Fai Gee, writing for the Spring 2012 edition of the International Productivity Monitor, calculated the extraordinary mismatch between productivity gains and wages. Their study found:

“During the 1973 to 2011 period, the real median hourly wage in the United States increased 4.0 percent, yet labour productivity rose 80.4 percent. If the real median hourly wage had grown at the same rate as labour productivity, it would have been $27.87 in 2011 (2011 dollars), considerably more than the actual $16.07 (2011 dollars).” [page 31]

Almost every penny of the income generated by that extra work went into the pockets of high-level executives and financiers, not to the employees whose sweat produced it.

Working people in Canada have fared little better. Labor productivity increased 37.4 percent for the period 1980 to 2005, while the median wage of full-time workers rose atotal of 1.3 percent in inflation-adjusted dollars, according to a Fall 2008 report in theInternational Productivity Monitor. The authors of this report, Andrew Sharpe, Jean-François Arsenault and Peter Harrison, provided caveats as to the direct comparability of productivity and wage statistics, but found the mismatch to be real as labor’s share of Canadian gross domestic product has shrunk. The authors note that, in Canada, almost all income gains have gone to the top one percent. They write:

“If median real earnings had grown at the same rate as labour productivity, the median Canadian full-time full-year worker would have earned $56,826 in 2005, considerably more than the actual $41,401 (2005 dollars).” [page 16]

Wage erosion is also at work in Europe. A Resolution Foundation paper found adifferential between productivity and wage gains for British working people, although smaller than that of the United States. It also found that British workers did not lose as much ground as did French, German, Italian and Japanese workers. That conclusion is based on a finding that the share of gross domestic product going to wages in those countries has steeply declined since the mid-1970s.

That German workers also suffer from eroding wages might seem surprising. But it should not be — German export prowess has been built on suppressing domestic wages. In 2003, the then-chancellor, Social Democrat Gerhard Schröder, pushed through his “Agenda 2010” legislation, which cut business taxes while reducing unemployment pay and pensions. German unions allowed wages to decline in exchange for job security, which means purchasing power is slowly declining, reinforcing the trend toward Germany becoming overly dependent on exports.

Making a few calculations from International Labour Organization statistics on labor productivity and wages provided for individual countries, I found that average real wages in Germany declined 0.5 percent per year for the period of 2000 to 2008 while German labor productivity increased 1.3 percent per year. (The only years for which data is available for both.)

You can’t sell it if everybody is broke

Despite the overwhelming evidence of increasing hardship for so many people, economic orthodoxy insists we scream in horror at the very thought of raising wages. Such screaming is based on ideology, not on facts. Low-wage workers in the United States earn far less today than they did in 1968, despite their having a much higher level of education now as compared with then. The federal minimum wage is 23 percent lower than it was in 1968 when adjusted for inflation.

An Economic Policy Institute study by Heidi Shierholz, released in January 2014, foundthere are nearly three job seekers for every one open position. The lack of jobs reflects larger structural weaknesses, not a “lack of education” as orthodox economists, committed to austerity, continue to claim. She writes:

“Today’s labor market weakness is not due to skills mismatch or workers lacking skills for available jobs, but instead due to weak demand. If today’s high unemployment were a problem of skills mismatch, some sizable group or groups of workers would be now facing tight labor markets relative to 2007, before the recession started. Instead weak demand for workers is broad-based; job seekers dramatically outnumber job openings in every industry, and unemployment is significantly higher at every education level than in 2007.”

Household spending accounts for 69 percent of the U.S. gross domestic product; persistent unemployment and stagnant or falling wages can only lead to continuing economic weakness. Demand is what creates jobs. Raising wages, which in turn would stimulate demand, would, in a logical world, appear to be one route to ameliorating stagnation. In fact, a strong consensus exists that, contrary to what the one percent and their hired propagandists say, raising the minimum wage would be beneficial.

A Center for Economic Policy and Research paper surveying two decades of minimum-wage studies concludes:

“Economists have conducted hundreds of studies of the employment impact of the minimum wage. Summarizing those studies is a daunting task, but two recent meta-studies analyzing the research conducted since the early 1990s concludes that the minimum wage has little or no discernible effect on the employment prospects of low-wage workers. The most likely reason for this outcome is that the cost shock of the minimum wage is small relative to most firms’ overall costs and only modest relative to the wages paid to low-wage workers. … [P]robably the most important channel of adjustment is through reductions in labor turnover, which yield significant cost savings to employers.” [pages 22-23]

Similarly, the National Employment Law Project reports a strong consensus in favor of increasing the minimum wage:

“The opinion of the economics profession on the impact of the minimum wage has shifted significantly over the past fifteen years. Today, the most rigorous research shows little evidence of job reductions from a higher minimum wage. Indicative is a 2013 survey by the University of Chicago’s Booth School of Business in which leading economists agreed by a nearly 4 to 1 margin that the benefits of raising and indexing the minimum wage outweigh the costs. …

Two decades of rigorous economic research have found that raising the minimum wage does not result in job loss. While the simplistic theoretical model of supply and demand suggests that raising wages reduces jobs, the way the labor market functions in the real world is more complex. Researchers and businesses alike agree today that the weight of the evidence shows no reduction in employment resulting from minimum wage increases.”

The University of Chicago, the infamous incubator of the “Chicago School” ideology that provides the intellectual “justification” for neoliberalism, can hardly be described as a pro-labor bastion.

Catching up with the demands of 50 years ago

One of the demands of the March on Washington in 1963 was a minimum wage of $2 an hour. Adjusted for inflation, $2 an hour in 1963 would be worth $15.35 today. Yet the federal minimum wage in the United States is $7.25 an hour, and the highest minimum wage mandated by any state government is Washington’s $9.32.

The $10.10 an hour lately proposed by the Obama administration sounds like an improvement when compared with current rates, but in reality it is the usual crumbs on offer by the Democratic Party — the White House is proposing two-thirds of what was demanded 50 years ago!

Rather than settle for the Democrats’ “austerity lite,” a growing movement is demanding the minimum wage be increased to $15 an hour. When a broader perspective is used — drawing on historical demands and, as noted above, that the median hourly wage should be around $28 — the tired arguments that businesses “can’t afford” any raise to the minimum wage fall apart. Sarah White, an activist with Socialist Alternative, which has launched a national campaign for a $15 minimum, writes:

“To fight against the growing movement to raise the minimum wage, mega-corporations are trying to deflect attention from their super-profits by spending huge sums of money on publicity focusing on the ‘concerns of small business.’ Socialist Alternative is very open to helping small businesses — but not on the backs of the workers. Everyone working full-time deserves a decent living. Help for small businesses can be organized by taxes on big business (which are at historically low rates) and eliminating corporate welfare to subsidize small businesses, along with cutting the property tax burden on small businesses. … Raising the minimum wage will help small businesses by increasing the spending power of their potential customers.”

Exorbitant rent increases have forced countless small businesses to close in gentrifying neighborhoods across the country. Commercial rent control that would leave mom-and-pop businesses with a low enough overhead to survive, instead of them having to send all their money to landlords interested in nothing more than squeezing every dollar out of a neighborhood, would do vastly more good than any potential harm caused by a $15 minimum wage.

Close to 60 percent of families below 200 percent of the poverty line have a family member who works full-time, year-round and 47 million U.S. residents rely on food stamps. At the same time, the world’s 1,645 billionaires have an aggregate net worth of US$6.4 trillion, an increase of $1 trillion in just one year.

Individualistic ideology, promoting the idea of personal responsibility for unemployment, low wages and economic insecurity, is a crucial prop holding up the system that leads to such disastrous results. There are no individual solutions to structural inequality.

Pete Dolack is the author of the forthcoming book It’s Not Over: Lessons from the Socialist Experiment, a study of some of the attempts organized to create societies on a basis other than capitalism with an eye toward an understanding of today’s world and finding a path to a better world tomorrow.